Comprehensive and personalized provision of investment advice, tailored to each client's profile, responding effectively to the constantly changing financial conditions of international markets. Consulting - investment proposals are our main activity. We have the ability to put "open architecture" into practice in our selection of proposals. In other words, to use global investment tools across the entire range of investment risk from different custodians in Greece and abroad.

BASIC STRUCTURES

- Wide range of partners around the world

- Full account opening support

- Preparing of funds’ reception

- Multiple choice of international banks

- Investment reports

- Internal analysis department

- Legal and tax information

HIGH FIDELITY SERVICES

- Risk-adjusted investment solutions

- Continuous renewal of products - stocks, bonds, mutual funds

- Investment analysis, taxation and institutional framework

- Recommendation of tax advisors, legal advisors

- Internal regulatory compliance support according to tax and legislative regime

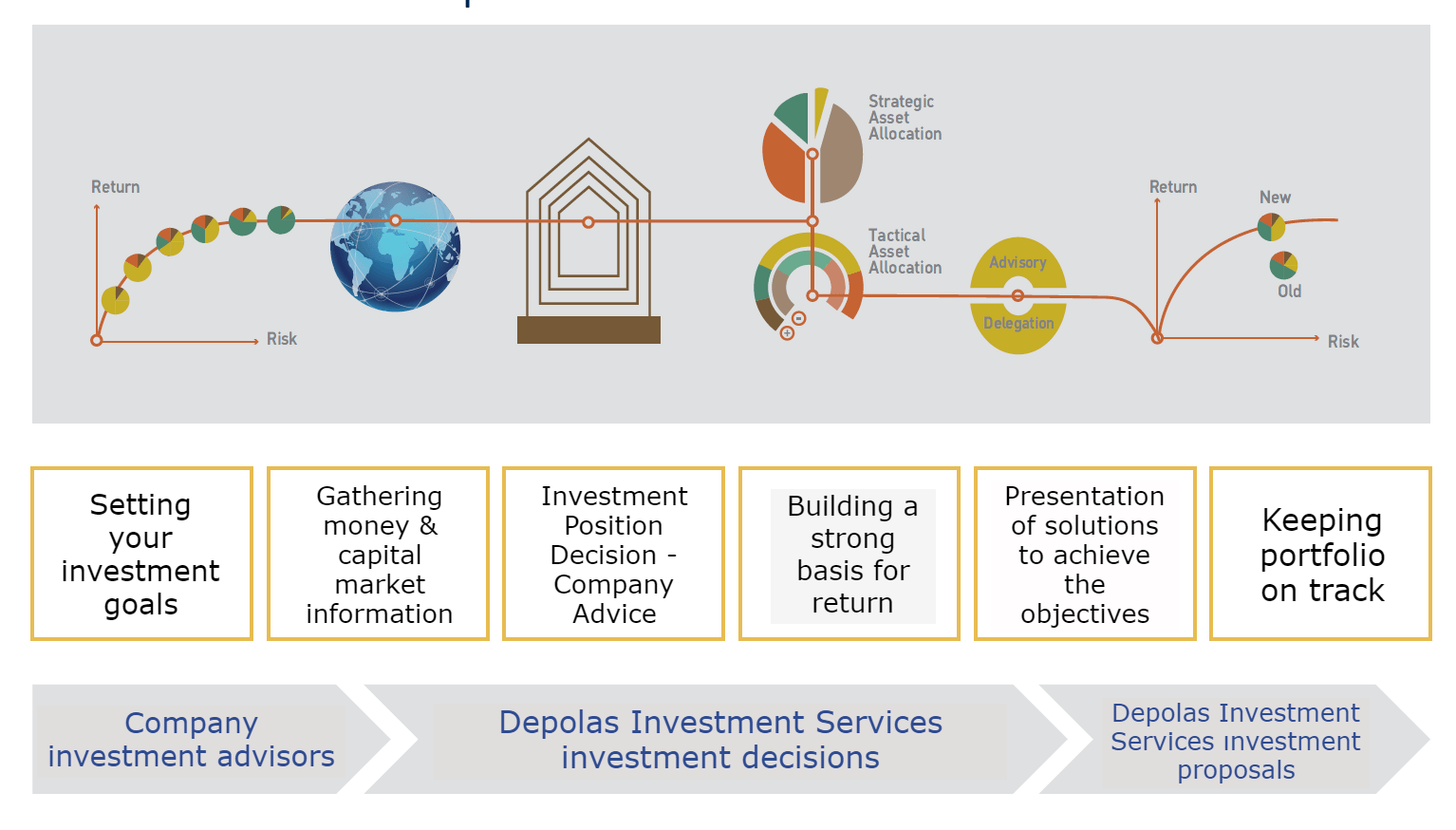

The certified Investment Advisor follows a process where, through dialogue with the investor, he records his needs, his tolerance for risk, his investment horizon and his investment goals, thereby defining his personal investment profile (tailor- made investment profile). In the next stage, the personal advisor together with the investor determine the desired investment strategy. The portfolio of each client is systematically monitored and the personal advisor is in constant communication with the investor, submitting proposals for the possible need to restructure his portfolio based on developments in global money and capital markets and the positions of the company's investment committee.

Personal advisor

- Determine Client’s Investment Profile

- Personal service from a dedicated advisor

- In-depth consultant-client collaboration which ensures fruitful and long-term cooperation

- Fair pricing of consulting services

The investment advisor will help

- Formulate a financial plan based on strategy and goals

- Understand the investment characteristics (liquidity, yield, risk) and the different types of risk

- Strengthen your discipline by avoiding intense buying and selling activity and blatant actions at the extremes of markets

- Avoid risky investment choices, foolish behavior and mob mentality

- Introduction to other professionals

Advantages

- Ensure better risk management and create a framework to protect and grow your wealth

- Improve your income or cash flow

- Get a financing plan for your children's studies

- Minimize taxation