HISTORICAL PROFILE

LEON DEPOLAS INVESTMENT SERVICES S.A. was established in 1991 and is the evolution of the brokerage office of Leon Depolas, which started its operation in the Hellenic Capital Market in 1985, the year when Leon Depolas was registered as a stockbroker after 15 years of activity in the stock market sector. Leon Depolas has been appointed Chairman and CEO of the company from 1991 to 2015. He has been a member of the Board of Directors of the Athens Stock Exchange for a number of years, Chairman of the Ethics Committee (compliance) of the ATHENS EXCHANGE MEMBERS ASSOCIATION and a member of its Board from its establishment until 1996. Through his participation in various experts’ committees throughout the last 30 years, he contributed to the modernization and development of the Athens Stock Exchange, and the Hellenic Capital Market. In 2014, the company acquired Athenian Brokerage SA, one of the oldest and most renowned brokerage firms in Greece, expanding in that way its base to 30,000 clients. Since 2015, President and CEO of the company is Mr. Pavlos Depolas, who has been working for the company since 1996 and has served as Director of Stock Trading and Vice President, while he was also a member of the Board of ATHENS EXCHANGE MEMBERS ASSOCIATION..

COMPANY PROFILE

Η LEON DEPOLAS INVESTMENT SERVICES’ main task is the provision of personalized services to its clients to optimize their portfolios management. In this direction, the company constantly invests in the education and training of its staff, the most modern and reliable infrastructure, as well as the implementation of strict internal procedures, in order to fully meet the high demands of modern capital markets. A comparative advantage of the company is its sound capital base. The company by taking advantage on it has established and retained its longstanding experience and prestige in the market in order to progress, adapt and develop furthermore with prudent and steady steps.

Your money our Value

Our corporate culture is summarized by “Your money is our Value”. We have a strong sense of responsibility towards our clients and their funds. Prudence has always been our mandate, and the company's guiding policy is to protect the interests of our clients by applying the triptych of professionalism: optimal solutions, reliability, confidentiality.

MANAGEMENT & SHAREHOLDERS

Chairman BoD & CEO: Depolas Pavlos

Vice President & COO: Tselios Georgios

Member BoD: Depolas Konstantinos

Member BoD: Chalkiadis Sotirios

Member BoD: Doukis Anastasios

Depolas’ family is the main shareholder of the company with a stake of over 95%. We consider the direct management by its key shareholders as an important strategic advantage of the company, as the interests of company, clients, partners, executives and shareholders are optimally guaranteed. This also provides the necessary flexibility for fast and assertive decision making in an ever-changing industry. The above is also confirmed by numbers, which show a high capital adequacy ratio, a sound capital structure and a growing market share.

INVESTMENT SERVICES PROVIDED

The range of services and products provided includes asset management, trading and custodian services in stocks, derivatives, bonds and mutual funds both in Greece and abroad as well as market making, margin trading, investment advisory and underwriting services.

In detail, LEON DEPOLAS INVESTMENT SERVICES SA has been licensed by the Securities and Exchange Commission for the provision of the following investment services in financial instruments.

(1a) Receiving and transmitting orders on behalf of clients

(1b) Execution of orders on behalf of clients

(1c) Trading on own account

(1d) Portfolio management

(1e) Providing investment advice

(1g) Placement of financial instruments without a firm commitment basis

(1f) Underwriting of financial instruments or placement of financial instruments on a firm commitment basis

(2a) Custody and management of financial instruments on behalf of clients, including the provision of custodian services and related services such as cash management or collateral management

(2b) Provision of credits or loans to an investor for a transaction in one or more financial instruments, mediated by our company, which provides the credit or loan

(2c) Advising companies on their capital structure, industry strategy and related issues, as well as providing advice and services on mergers and acquisitions

(2d) Provision of foreign exchange services conditional on their relation to provided investment services

(2e) Investment research and financial analysis or other form of general recommendations relating to transactions in financial instruments

(2f) Provision of services related to underwriting

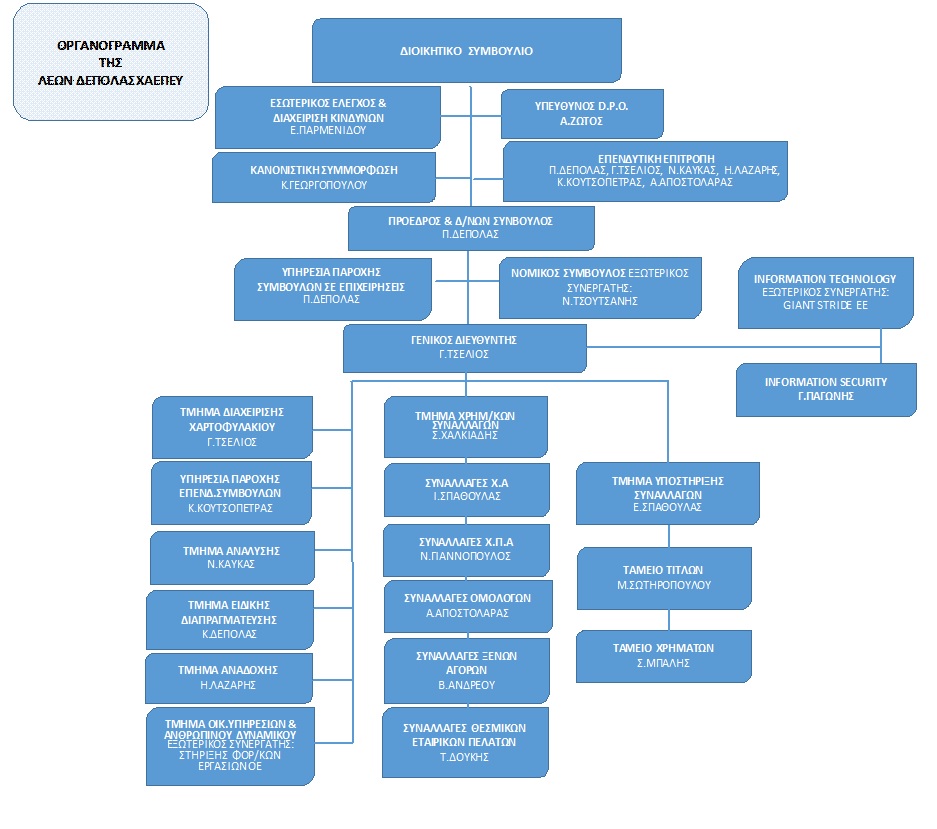

Organizational Chart

Click here to view the organizational chart in PDF

Capital Adequacy Indices

Corporate News

Market Share

Company’s Financial Statements

Company’s Certified Persons

Disclosures

Career Opportunities

Markets in Financial Instruments Directive (MiFID)